For institutions that rely heavily on their geographic area to build their student class each year, a declining prospect pool is often less important than a falling market share. Maintaining or growing the portion of students you attract in your market is a sign of competitive health, even in cases where the overall pool is shrinking. It signals that opportunities for recruiting success may be found in other locations within your market that align well with those you have already saturated.

It is no secret that national enrollment in the US has been declining since 2011. The Midwest and Northeast regions have been hit the hardest. The National Student Clearinghouse Research Center publishes a handy report each year for the general trend in your state. It does not adjust for type of institution (2 year, 4 year, public, or private). However, if your institution is maintaining or bettering the general trend you are almost certainly not losing market share. Additional research should be undertaken to get a true measure.

If you do discover that you are actually losing market share it may mean you are not meeting the needs of your customers (the students and their families) as effectively as your competition. This should always be viewed from a net tuition revenue standpoint. Efficient enrollment and superior retention efforts do often prove more profitable for the institution in the end than a simple focus on headcount. So, selectively recruiting for revenue over headcount is a valid strategy.

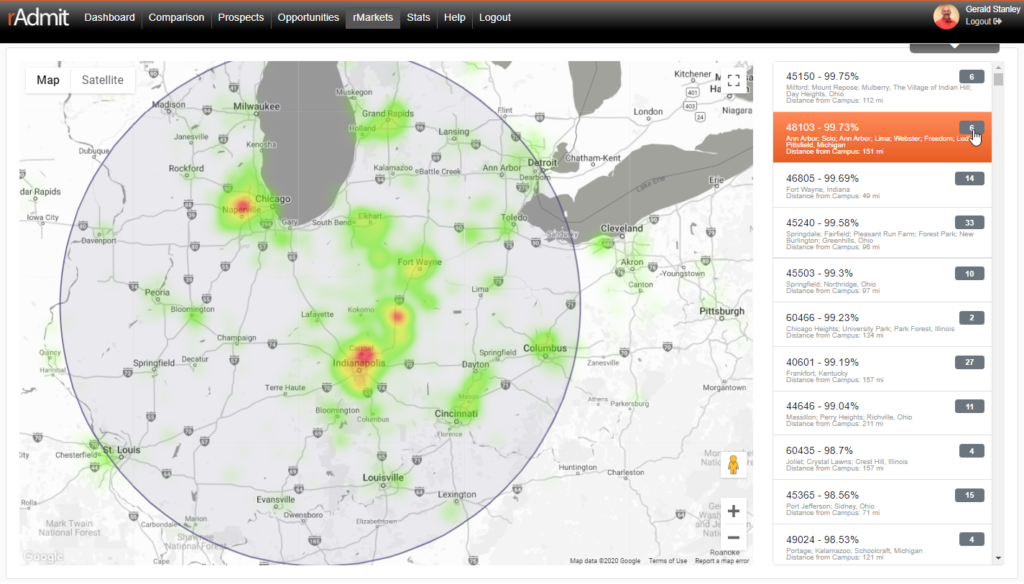

While maintaining and growing market share is an indication that you can be successful in other high-potential markets, expanding your recruiting horizons requires you to be able to accurately identify them. Inroads Analytics offers rMarket, a predictive tool that analyzes your historical student data and scores the locations within your market that hold the most promise for finding new students. rMarket will inform your name buys by determining the individual zip codes you should purchase.

As you seek to improve your competitive position and maintain or grow market share, consider empowering your frontline admissions team with the tools they need to win.